"So here it is merry Christmas, Everybody's having fun"

Monday, December 16, 2013

Slade's Christmas hit in 1973 prompts Payden & Rygel's Jeffrey Cleveland to think about how we will remember 2013 from an investment perspective.

The unmistakeable chorus from Slade's 1973 Christmas hit which has been a feature of almost every Christmas chart since, including this year where it entered at number 57, forty years to the day since its original release. In 1973, Britain joined the 'Common Market', we were in the midst of the oil crisis, inflation reached 8.4% and across the Atlantic, President Nixon took responsibility for the Watergate scandal (but denied any personal involvement).

How will we remember 2013 from an investment perspective when we look back several years hence? A year when growth finally seemed to take hold in the UK; when talk of "tapering" by the Federal Reserve mid-year spooked markets around the world with the fear that the liquidity tap, which rescued the global economy might be turned off? Whatever your personal memory, we will not be reflecting that this was the year that interest rates in the developed world started to rise. That particular milestone remains locked away for some time to come; why do we think that?

2013 brought us a new Governor of the Bank of England and Mark Carney duly introduced us to a new tool in his bag, "Forward Guidance". There's a new Chairman due at the Federal Reserve too as Ben Bernanke makes way for Janet Yellen and, as we look to 2014, expect central banks on both sides of the Atlantic to continue to use their full toolkit to manage their economies. A speech by Bernanke last month (think 'farewell tour') provided a short history of the evolution of monetary policy since the financial crisis, but he also opined on what drove longer-term interest rates in 2013.

Monetary policy traditionally operates by targeting short-term interest rates. However, since overnight interest rates hit 0% nearly five years ago, the Fed deployed two additional tools to stimulate growth: quantitative easing (QE) and forward guidance. The two tools are not perfect substitutes for each other as they impact longer-term interest rates in different ways.

Under QE, the central bank purchases a large stock of securities, lifting prices and depressing yields directly. Forward guidance, on the other hand, influences the market's view of the future path of overnight interest rates, which in turn impacts longer-term interest rates by managing expectations. Bernanke described the operation of forward guidance as such: "If monetary policy makers are expected to keep short term rates low then current long term rates are likely to remain low as well."

Why do distinctions between the different policy channels and tools matter for investors? When the mere prospect of a change in the level of QE ("tapering") rippled through fixed-income markets in the spring, interest rates lurched higher, puzzling the Fed; to them, higher interest rates as a result of fewer asset purchases makes no sense. Even if the pace of purchases lessens, QE is still taking place and new securities are still being added to the balance sheet (QE is after all running at $85bn per month) so in turn would still affect the total outstanding supply - i.e. continue to exert downward pressure on interest rates.

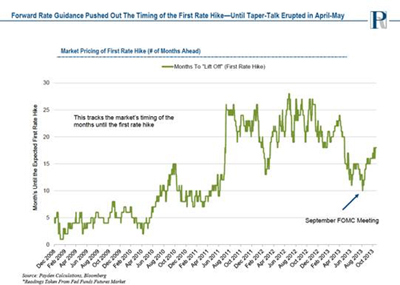

Bernanke concluded, it was not a change in the rate of QE, or tapering which caused the rise in longer-term interest rates, but instead an overeager market anticipation of the first fed funds rate hike – in other words, 'expectations'. In fact, market expectations of the timing of the first rate hike changed dramatically during the first half of this year. In late 2012 following the announcement of QE3, QE4, and forward guidance, the market expected the first rate hike 24 months in the future.

But, after the start of the "taper talk" in May, the market expected for the first rate hike as soon as Q2 2014. In his speech, Bernanke described such changes in expectations as neither "welcome nor warranted." While the Fed considered reducing its asset purchases, it had no intention of moving closer to raising interest rates.

And, as evidenced by the minutes from the October Federal Open Market Committee (FOMC) meeting released recently, Committee members spent a large portion of the meeting wrestling with how to deliver the message that "tapering" does not equal "tightening". Possible steps discussed: communications (speeches, etc.), changing the thresholds, improving official forecasts to reflect dovish bias and even reducing the interest rate paid on excess reserve balances. With nothing new announced we can only surmise the discussion is ongoing. What is clear: if interest rates rise due to changing expectations for Fed rate hikes, policymakers will seek to push back.

Since their decision not to taper in September, the Fed appears to have been more effective in convincing markets of their plans for future short-term rates. Our chart shows the market now anticipates the first rate hike will occur in mid-2015. And the part of the curve most heavily influenced by Fed policy, the two-year Treasury note, saw yields settle back down to their lowest levels in nearly six months.

So in the words of Noddy Holder, "Look to the future now, It's only just begun". Merry Christmas Everybody.

Written by Jeffrey Cleveland, principal and chief economist, Payden & Rygel