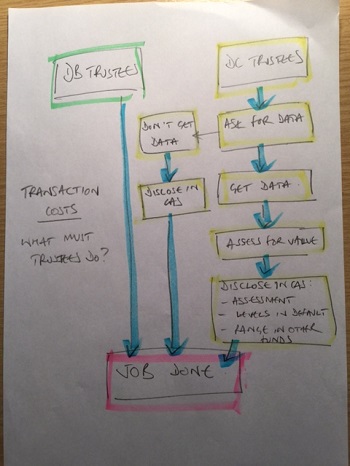

Trustees: who are we supposed to consult on investments?

Thursday, December 15, 2016

Richard Butcher explains consultation isn't as complex as it seems.

No one has ever suggested that pensions legislation is lacking in volume. Sure, from time to time, the politicos and regulators suggest it lacks comprehensiveness – although often they are looking through a lens clouded by the wrong motives or desire to micro-manage – but volume? No. Nor is it always simple. In fact, again often misguided by that desire to micro-manage, it is usually horribly complicated.

So, voluminous and complex – what could possibly go wrong? Consultation on pension investment is one such area but, in truth, it's not too complex – although it is perhaps somewhat bureaucratic.

All trustees

All trustees, both defined benefit and defined contribution, need to have a statement of investment principles (SIP). In order to construct your SIP, you are required to seek advice from someone you reasonable believe is suitably qualified to give you that advice. In other words, you must consult, normally, your investment consultant. For the advice that your adviser gives you to be valid, you must ensure you have properly appointed them.

DB trustees

In constructing your SIP you are, normally, required to consult the employer or employers sponsoring the scheme. This is because they ultimately bear the cost of the scheme and therefore the consequences of the chosen investments. That said, you retain the executive power, i.e. you make the investment decision (see what is a consultation below).

DC trustees

DC trustees also have to consult with the employer sponsoring the scheme – although this is due to the way the legislation has been constructed over the years (DC was a supplement to DB) as opposed to being for a specific reason (the law is the law, though). This is even the case for master trusts, although there are one or two mechanisms that can be adopted to ease this particular burden. DC trustees are not required to consult members, although they do have to provide a mechanism for members to make representations to the trustees – on any matter, not just investment. They also have to consider whether the default investment strategy and other investment options represent good value for the members, and they must disclose this assessment, along with a copy of the SIP, in the Chair's annual statement.

What is a consultation?

To tick the consultation box, trustees must provide the other party with all relevant information and give them a reasonable period of time (usually no less than a month) to respond. If the other party chooses to respond, the trustees are obliged to consider this. They are not; however, obliged to comply with the response.

So despite all the noise and bureaucracy, this part of the process isn't that complicated after all.

Written by Richard Butcher, Managing Director, PTL.