Hedging – What should you be doing to control your pension scheme's investment risk?

Thursday, February 25, 2016

Simon Cohen of Spence & Partners discusses the benefits of reviewing interest rate hedging policies

Marks & Spencer (M&S) recently revealed the results of their pension scheme valuation. They are now one of a small but growing number of defined benefit (DB) pension schemes showing a surplus. The company credited two key areas that led to these results:

1. Outperformance from return seeking assets

2. Being fully hedged for interest rate purposes

What can other schemes learn from this?

This shows the impact that careful consideration of pension scheme risks can have on investment decisions. DB pension schemes are highly sensitive to interest rate fluctuations; a broad rule of thumb is that a 1% fall in interest rates would lead to a 20% increase in pension scheme liabilities.

In this case, with full hedging of interest rate risk, as interest rates have fallen the M&S scheme's investments have risen at least in line with the liabilities, allowing the strong performance of the rest of the investment portfolio to claw back the deficit, and over time grow into a surplus.

Essentially, this means taking a stance on which risks are likely to be unrewarded and to take steps to protect the scheme from those risks. In this case, it's likely that M&S did not believe that there was value in taking interest rate risk and therefore decided to hedge it. On the other hand, they considered that investing a portion of their assets in return seeking assets such as equities and property, was likely to be rewarded so they chose to take such risks.

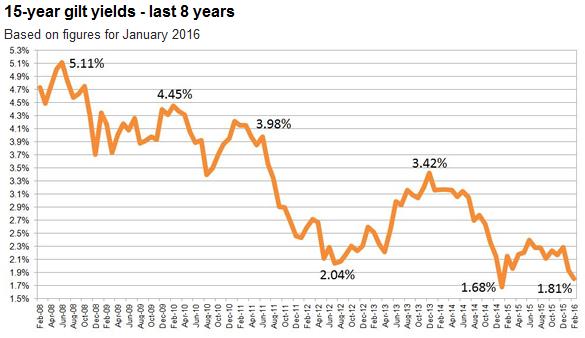

Source: http://www.sharingpensions.co.uk/gilt-yields-chart-latest.htm

Why has interest rate hedging led to such a positive result?

Interest rates have been falling for some time now (see graph above) and have remained low since the 2008 global financial crisis. Falling interest rates have seen pension scheme deficits soar since then, as very few schemes would have been adequately protected from interest rate changes.

February 2016 has seen some record low gilt yields, as people have sought to invest in these high quality assets following concerns about the global economy. For many schemes this has meant falling funding levels over the past six to nine months. However those with interest rate hedging in place would have been, to a degree, protected from this.

What should pension schemes do now?

Given that interest rates are so low it is reasonable to expect them to rise over the medium to long term, and market expectations of future gilt yields support this theory. If rates were to rise faster or higher than current expectations, unhedged schemes could benefit from falling liabilities as a result.

However, the current economic climate means that it would be foolish to ignore the impact of volatile interest rates. Quite a few countries around the world are now experiencing negative short-term interest rates – there is no reason why this couldn't happen in the UK.

This means that it isn't a one-way bet, so schemes should not wait for interest rates to rise before putting in place hedging plans. Instead we would suggest they review their current position. M&S, for example, are continuing to push ahead with their de-risking strategy as far as 2032 despite already reaping the rewards over the first few years of the strategy.

Schemes can benefit from reviewing their investment strategy using stochastic asset liability modelling, a technique that projects the scheme's funding position on a wide range of plausible economic scenarios. Applying this technique to a number of different investment strategies can help schemes understand the nature and size of risks that they are running and help determine which investment strategy has the best risk-return characteristics for their particular circumstances. Historically, such modelling has been the preserve of bigger pension schemes primarily because of the costs of doing it. However, thanks to modern technology this modelling is now widely available and can be accessed by even the smaller schemes at reasonable costs.

Armed with an understanding of those risks, schemes can then decide, as M&S did, whether they want to accept or hedge those risks and potentially end up in the enviable position of having a surplus.

Simon Cohen, Head of Investment Consultancy, Spence & Partners.