Introduction – What is UK Student accommodation?

The UK's Higher Education system has seen consistent growth in student numbers over the last decade, and currently includes 1.68 million (1) full-time university students at 160 institutions (2). This increase in the student population has not, however, been matched by an increase in the supply of Purpose Built Student Accommodation (PBSA), with only a quarter of students in the UK having access to purpose built housing. While most institutions try to offer first year students an accommodation place 'on campus', this University-owned stock is generally old and under-funded. Many users, particularly overseas students (in which there has been a 22% increase over the last five years), require modern facilities including broadband, en-suite bathrooms and good communal space, but private sector purpose-built student accommodation typically meets only a small fraction of overall student demand (6%).

New supply has been constrained by a lack of development finance but also due to planning restrictions. PBSA is built and operated to comply with UK planning-use class C2 "Residential Institution" and as such should only be used for the purpose of housing people in education. Whilst there is clearly a relationship with the residential market (which could be substituted for student housing), it is not direct. The uses of student housing are by definition more limited, typically providing an advantageous yield premium of 100bps – 300bps over residential in the current market.

Privately-owned PBSA takes two main forms:

1) Where a higher education institution takes a long term agreement on privately-owned accommodation and then either manages in-house or with a third-party manager;

2) Direct-let accommodation, where rooms are individually let to students on 12 month tenancies either by a specialist owner or more typically a third-party manager on behalf of an investor. New tenancy agreements for the next year of study are signed throughout the prior year helping to improve the security of income for owners.

From an investor's perspective, direct-let space more closely follows the fortunes of underlying tenant demand as with other commercial property sectors. Long leased student accommodation, by contrast, is more like a long-duration low–risk covenant (often index-linked) bond and as such is priced more expensively.

The UK market is relatively immature (£2.9bn of transactions in 2013) when compared to the US market but is more established than in other European countries and is undoubtedly growing in liquidity as more institutional investors enter the sector.

UK student population

The UK's Higher Education system is oversubscribed, with 1.68 million (3) full-time university students and only 10 places for every 14 university applicants (4). The UK has seen a rapid rise in student numbers with a 15% increase in university applicants between 2008 and 2013 (5), which suggests the sector is resilient to economic cycles. In part, this has been driven by increased interest from the international student market, which views the UK as a place to receive high quality tertiary education. Over the last five years there has been a 22% increase in overseas students attending UK universities full time (6).

, gaining market share in recent years due to the relatively lower tuition fee load versus American universities. One of the primary selection criteria for international students is English as the language of instruction. Globalisation accelerated the use of English as an international business language, underpinning the need for cross-border education. Students choose English-taught degrees to become globally employable, to have a competitive edge in the local marketplace or to use it as a path to emigration.</p><p></p><p>@@LaSalle-image-2.jpg)

In 2011 there were significant concerns around the impact of the introduction of significantly increased tuition fees, leading to a reduction in applications in 2012 as a greater number of students elected not to take a gap year and enter higher education in 2011, while equally a greater number of students chose to take a gap year in 2012 when otherwise this may not have been the case, deferring entry until 2013. Applications were again up in 2013, above 2011 levels.

Supply of student accommodation

Full-time students represent 72% of the total UK student population (with the remainder being part-time students with other occupations). Of this group, only 25% have access to purpose-built student accommodation and only a fifth of this group live in privately-owned and managed purpose-built accommodation.

Due to the lack of purpose-built student accommodation, most of the increase in demand has been absorbed by Houses in Multiple Occupation (HMO) and the Private Rented Sector (PRS). PRS is subject to upward rental growth pressures, caused by population growth, a general housing shortage and relatively more affluent graduates. By contrast, private halls, even with rents being increased annually, may seem like good value on an all-inclusive basis.

The rate of new building for student residences has not kept pace with the growth in students, with only 186,000 purpose-built rooms in private ownership (9). There has been little development, particularly outside London, as banks have generally been unwilling to finance construction in recent years and other sources of capital have, to date, been slow to recognise the sector.

Even against this backdrop, however, the growth in the number of specialist operators is proof of the business opportunity afforded by the sector and of a maturing market, with increased competition and choice. Nationally the number of both degree course places and places in halls remains over-subscribed. The type of space being demanded is also changing, with occupants preferring modern facilities including broadband access, en-suite bathrooms and good communal space (including laundry facilities & gymnasiums). As a result, and with reported 99%+ occupancy for purpose-built accommodation and rental pressures in the private rented sector too, rents should continue to grow annually in most cities, at least in line with inflation.

.</p><p>The sector has become increasingly stable and recognised as a result of high occupancy rates and robust income. UK institutions and private investors are buying directly, together with specialist funds and overseas vehicles. Investment volumes have increased significantly, with £2.9 billion transacted in 2013 (11).</p><p><em><br /></em> <br />@@LaSalle-image-5.jpg)

Whilst it varies by year, since 2007 around 30% of transactions by value have been for assets in London. With a large student population studying at a broad range of institutions it is in line with expectations that London should be one of the first markets to see significant investor interest in an emerging segment of the market.

One of the issues has been the lack of good properties to buy. Developers are joining forces with established operators in order to strengthen their offer, particularly to lenders. For smaller scale deals and new entrants into the market debt sources remain extremely limited, certainly outside of London. Regional development has been relatively constrained as lending criteria have not-favoured direct let properties, except in a few high value towns.

Accommodation specifications continue to improve, trending towards interior design-led schemes.

Market outlook

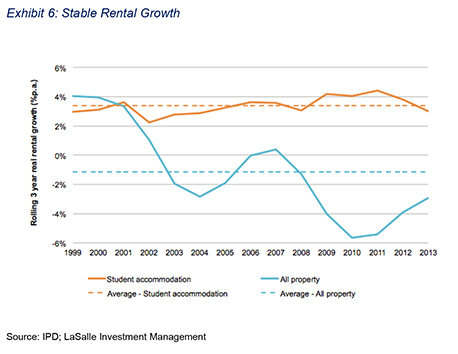

UK student accommodation provides a far more stable, positive rental growth in income than traditional commercial real estate investments over the long-term.

Student accommodation has consistently delivered real rental growth over three year rolling periods in excess of 2% per annum and average three year rolling real rental growth has been in excess of 3% p.a. With a strengthening UK economy the outlook for commercial property rental growth is more positive than it has been for some time, but student housing rental growth is still expected to perform at least in line with the commercial property market overall albeit at lower levels than observed over recent years (nominal growth of 3 to 4% p.a. rather than 6% as would be implied by historical data) as the sector matures and market inefficiencies are reduced.

Nominal rental growth of 3% to 4% combined with income of 5% to 6% and inward yield movement as the sector is increasingly targeted by investors leads us to believe that PBSA has prospects for outperformance during the next market cycle whilst also preserving capital over the long term. The only major risk to growth is that of oversupply, a situation which, at present, looks to be a long way off.

Assessing Where to Acquire Purpose-Built Student Housing

While there are a number of top-down drivers to consider when assessing which locations represent the better investment opportunity for student housing, as can be seen from the below, while a top-down approach can be instructive, there is considerable variation between local markets and assessing individual opportunities as they arise is critical.

Student Affluence

Whilst not a definitive indicator of the ability to pay for, and likelihood to demand purpose-built accommodation, the proportion of privately educated students is a good guide to its likely success. The majority of Universities with high proportions of privately educated students are either well-catered for (Oxford, Cambridge, St. Andrews) or in London – helping to bolster the case for London accommodation.

Cities such as Leeds and Nottingham fall into the next strata. In both of these towns it is the 'primary' university that has a higher proportion of privately-educated students and has fared better in terms of maintaining student numbers. Cardiff is interesting; supply and demand are attractive, student numbers have grown well, and whilst the proportion of privately-educated students is lower, the proportion of students from Middle-class backgrounds is high – this disconnect perhaps reflecting the number of students from Wales where there is less emphasis on private education.

Bristol and Newcastle-upon-Tyne both exhibit similar characteristics with the 'primary' university's student population being comprised of 40% privately educated students whilst in the 'secondary' university's is only 9%. When considering the apparent level of under-provision of PBSA in a market it is important to consider the dynamics of the local market and consider the local institutions individually.

there are a number of factors driving demand. In Exhibit 8 below we have considered 30 major student towns included in a recent analysis by Savills, and assessed their strengths in terms of the overall supply/demand ratio as well as student growth and the percentage of international students. As can be seen, no location is considered "strong" across the board.</p><p><em><br /></em></p><p>@@LaSalle-image-8.jpg@@</p><p></p><p><br /><strong>Supply</strong><br /><br />Supply of purpose-built student housing is limited throughout the UK, with few University towns providing sufficient PBSA stock to cover more than a third of the student population (see Exhibit 5 below).</p><p><em><br /></em></p><p>@@LaSalle-image-9.jpg)

Growth in Student Numbers

The top 24 UK universities formed the Russell Group in the mid-1990s to represent their members' interests and coordinate with government. In reality, the Russell group is short-hand for the more highly regarded institutions in the UK. However, it is the groups below the top 20 (Russell group) universities that have seen stronger growth of student numbers, particularly new universities providing more vocational courses. For example, Kingston, Bournemouth and Cardiff (where fees are attractive for Welsh nationals) have seen student numbers grow by more than 20% over the last decade, whereas London's student numbers have remained flat and Bristol and Liverpool have actually seen declines (although currently on the rise again).

?

Overseas Students

A further consideration when looking at lower-ranking universities demonstrating higher-than-average student growth is the relatively lower percentage of international students. There is a general acceptance that one of the key pockets of demand for quality purpose-built housing comes from overseas students, who are typically prepared to pay higher rent for superior accommodation. Of the student towns considered, the average proportion of overseas students is 20%. Of the markets where student numbers have grown most strongly it is interesting to note that the proportion of overseas students is typically no more than average at most, Exeter and Oxford being notable exceptions. A student town such as Bournemouth may not normally attract the attention of investors, with a lower than average proportion of overseas students but as well as seeing strong growth in student numbers it also has a low supply of purpose built accommodation (enough to accommodate only 22% of full time students). A similar situation is true in Cardiff and Portsmouth.

Funding for, or investment in new accommodation in undersupplied locations with growing student populations and well-ranked universities not necessarily in the upper academic echelons may present an opportunity. However, these "newer" or more vocational institutions typically have lower levels of international and privately educated students, which are indicators of the likely demand for purpose-built accommodation. Few locations meet the full spectrum of criteria discussed above; careful consideration would therefore need to be made on a case by case basis before any investment is pursued.

Conclusions

Purpose-built student housing within the UK is a maturing asset class attracting increasing levels of institutional investor interest. The UK is the world's second largest international student market, and has seen overall student numbers increase by a third over the last ten years. Supply of purpose-built student accommodation has not kept pace with growing student numbers, creating a significant supply-demand imbalance within the majority of the UK's university towns. While investors must be selective when making investments, the student housing sector throughout the UK presents an attractive opportunity to access stable, high-income returns with the potential for yield compression in the near-term.

1 Source for data : HESA Statistical Release 197 Total Number of Full Time Students 2012/13

2 Source for data : HESA2012/13

3 Source for data : HESA Statistical Release 197 Total Number of Full Time Students 2012/13

4 Source for data : UCAS 2013 Application Cycle: End of Cycle Report (495,600 places for 677,400 applicants)

5 Source for data : UCAS

6 Source for data : HESA

7 Source: OECD and UNESCO Institute for Statistics – "Education at a Glance 2013", June 2013

8 Note: of the 310,000 'institution maintained' beds approximately 90,000 are privately owned and are let on nomination agreements with an institution

9 Source for data : CBRE , Student Housing Outlook for 2014, December 2013. Note that approximately 90,000 are let on nomination agreements with an institution

10 Source: Knight Frank Residential Research/IPD, April 2012

11 Source: Real Capital Analytics, May 2014

12 Source: Knight Frank, "2014 Student Property"