Pension plans are evolving, and the vehicles they use to invest in real estate are adapting alongside them. All pension systems have the same goal: providing retirement income. But they reach this goal by many different paths.

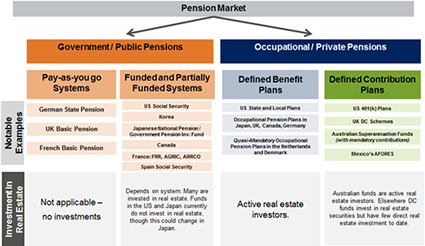

The diagram below highlights the variety of structures used. Most countries mix national pension schemes, like US Social Security, with occupational pensions not administered by the government. But countries mix them in different ratios and use different structures (i.e. defined benefit vs. defined contribution) – giving rise to significant diversity in the ways that pensions invest in real estate.

Two secular shifts are underway in many of the world's largest pension markets. First, there is a trend toward greater openness to real estate investment by investors that historically have had little or no allocation to the asset class, including both funded public pension systems and defined contribution (DC) plans. Second, within the private, occupational pension market, many employers continue to shift from a defined benefit (DB) model of guaranteed benefits to the DC model. DB plans continue to be important but fewer are open to new members.

Pension Market Structures

Figure 1: Wide Mix of Pension Structures

As shown above, pension spending can be split broadly between public, government-funded pensions and occupational private pensions. In Continental Europe, Japan, and Korea, government pensions provide the lion's share of retirement income. In Germany and France, government pensions are primarily funded directly on a pay-as-you-go basis in annual budgets. Markets with generous pay-as-you-go pension systems, like Germany and France, tend to have lower relative levels of pension assets – as highlighted in Figure 2 below*.

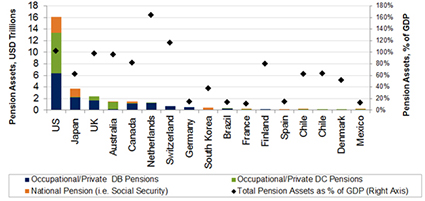

Figure 2: Total Pension Assets, by Market, in US Dollars and as a Share of GDP

Funded public pensions in Korea, Japan, Canada and the United States give rise to large reserve funds. Many of these funded national pension plans are major players in real estate capital markets.

More public plans are recognizing the valuable role real estate can play in mixed asset portfolios. The largest – Japan's Government Pension Investment Fund (GPIF) and the US Social Security Trust Fund – are not real estate investors, but this may change in Japan. In November 2013, a government reform panel recommended that GPIF consider diversifying into alternative investments. In Germany, reforms since 2001 have made the basic state pension less generous and shifted saving to private pensions.

84% of global pension assets come from the six $1 trillion+ pension markets: the US, Japan, UK, Australia, Canada, and the Netherlands. The variation in pension assets across markets, shown in Figure 2, is driven by the relative attractiveness of other savings vehicles, like life insurance, different tax treatments, and, as mentioned, the level of benefits provided by national pay-as-you go systems.

Figure 2 also shows that while government-administered pensions are very large, most global pension assets are held by non-government administered funds. This broad category of pensions – often called "private", "occupational", or "autonomous" - holds 80% of all global pension assets, with the other 20% held in national pension reserve funds. Occupational pension plans range from the retirement plans for US state and municipal employees to Australia's superannuation funds.

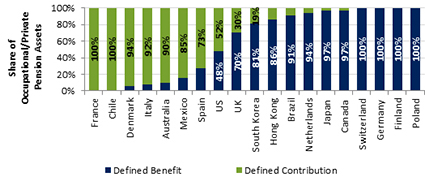

Occupational pensions split into two main structures: defined benefit (DB) plans - with guaranteed levels of retirement income - and defined contribution (DC) plans - where retirement income depends more on employees' saving and investment decisions. Fast growth of DC plans is slowly changing the structure of many pension markets. Below, Figure 3 shows the current mix of DB and DC plans by market.

Figure 3: Defined Benefit vs. Defined Contribution Pension Structure

This shift toward DC presents both challenges and opportunities for real estate capital markets. One challenge is that DC plans often put a high value on liquidity and have not historically invested in direct real estate. On the other hand, Australia's Superannuation plans show that DC funds can diversify into real estate and manage their liquidity. Regulatory changes have allowed Mexico's AFORES DC Funds to invest in real estate. And daily pricing of some US funds is making them more attractive to DC investment through mixed asset Target Data Retirement Funds. In the next section, we take a more detailed look at the changes underway in six major pension markets: Korea, Britain, the US, Germany, Australia, and Japan.

Survey of Pension Market Trends

Korea: Korean workers typically have a mix of pension funds: national pension funds at a minimum level, mostly mandatory by law, plus corporate pension funds. DC funds, first introduced in 2005, have been gaining share in the private, corporate portion of the market. Their share of Korea's private pension fund market was 19% in 2012. In terms of asset allocation, DC funds have invested more in riskier assets, with 20-25% of AUM in domestic equities. A change in regulation in October 2012 allowed DC funds to invest up to 40% in income-producing real estate funds. Even with the change, DC's allocation into real estate is still near zero because financial regulations allow only closed-end real estate funds and most of these funds are project-based vehicles for one-off deals, making it difficult to repay contributions in the middle of the investment period. However, additional regulation changes are expected. Once completed, there will likely be more DC fund investment into real estate.

Britain: The UK pension scene is changing fast from DB to DC. DB schemes will continue to be important as they hold total assets of USD $1.75 trillion but only 16% of these schemes are open to new members. Moreover, the average funding level is 84% of liabilities so there is a meaningful deficit though this has reduced recently as UK bond yields have increased. This potential funding burden on DB sponsors has forced employers to shift their schemes to DC. The government has recently started auto-enrollment into DC schemes for employees without pension plans and this will accelerate the move away from DB.

90-97% of contributors to auto-enrolled schemes are expected to select the default asset allocation. The main provider's allocation does include a 20% allocation to real estate. Current regulations suggest that much of this allocation will be to global real estate securities**.

United States: For several decades, employers have been moving toward offering new employees DC retirement plans and hybrid plans in place of DB plans. DC plans account for 48% of pension assets, up from about 20% in the 1970s. DC plans have lagged behind DB when it comes to diversifying into alternatives like real estate, but recent developments are beginning to open the path for greater DC real estate investment. Target Date DC Retirement Funds that hold a diversified basket of assets have trebled in size over the last five years, following regulatory changes in 2006, that allow for auto-enrollment. And new real estate fund structures are providing daily valuation and liquidity, historic obstacles for DC capital.

Germany: Germany has the world's longest running public pension system, which is the main source of retirement income for most Germans. Public pensions are supplemented by occupational private pensions – mostly DB – and tax-advantaged individual pension contracts. While private pensions are a smaller component of overall retirement savings than in the US and UK, the combination of Germany's aging population and regulatory changes since 2001 have contributed to the growth of private pension schemes - many of which invest in real estate.

Australia: In the last two decades there has been a strong trend away from DB to DC schemes, which now dominate. Australia's pension market, the world's fourth largest, is growing quickly thanks to significant compulsory pension fund contributions. Employees must contribute 9.25% of their income, which will increase in the coming years. Institutional pension funds invest approximately 10% in domestic core property. In recent years there has been a significant increase in Self-Managed Superannuation Funds (SMSFs) which now comprise nearly one-third of all retirement savings assets. SMSFs have five or less members, typically a family, and they hold a higher allocation to real estate on average (15%), commonly investing in residential rental properties.

Japan: Pension allocations to real estate are limited in Japan, just 2% of total assets on average. However, the government is seeking to transform its pension system so that it can achieve higher returns and meet the needs of Japan's aging population. To do this, pension funds need to shift from bonds to higher return assets, including real estate. DC funds, introduced in 2001, remain a very small part of the pension market in Japan, but are a potentially attractive option for better balancing the system's income and payments. Growth in the DC market would likely prompt more capital flows into the real estate market first though REITs.

Pension Fund Allocations to Real Estate

There are many excellent sources of information that track the allocation of DB plans to real estate***. There are fewer that track DC allocations. Our analysis of this data suggests that DB allocations are much higher (generally between 5% and 15%) than DC plans. Nearly all very large pension funds allocate to private equity real estate. And many of them allocated to both private equity and to listed real estate stocks. By contrast, only 35% of DC plans in the US offer an explicit real estate option, and the average allocation to the real estate option is less than 5%. At the same time, though, 74% of Target Date Funds include a real estate allocation, although no survey captures exactly how much these generalist funds allocate to real estate****.

A recent survey of DB plans from around the world by Cornell University and Hodes Weill Associates found that the average allocation to real estate is 9.8% and the average invested amount is 8.8%. If DC plans ever start to approach these allocations, there will be plenty of new capital coming into real estate for many decades to come. It will be healthier for the real estate investment markets if these allocations to real estate grow gradually over time, as they have been. The alternative -- forcing more capital into the relatively inelastic supply of investable real estate around the world – would create unsustainably high asset pricing and reduce real estate's ability to provide a competitive, low-correlated alternative to stocks and bonds as the sector has done successfully for nearly three decades in many countries. Too much capital could also finance a construction boom, which would be detrimental to the performance of the asset class.

We do not see DC plans rushing into private equity real estate or listed stocks, so we don't see this as a major risk for investors today. The gradual adoption of real estate investment by DC plans will be worth monitoring in the future. The DC sources of capital will prefer daily asset-pricing, high levels of transparency, and ample liquidity. The real estate industry will continue to evolve its investment structures to give these new sources of capital what they want.

Summary

With so many structural differences between pension markets, the similarity in trends across Japan, Australia, the US, Germany, Britain, and Korea is remarkable. Pension plans view real estate as a more mature asset class. As more plans invest in real estate, real estate capital markets should deepen further. And defined contribution (DC) pensions are becoming more important, spurring the creation of new investment structures for real estate. As they have been historically, real estate capital markets will be directly shaped by these changes in the world of pensions – the largest institutional investors in direct real estate.

ENDNOTES

* Data shown in Figure 2 is based on LaSalle Investment Management calculations and on data from the following sources:

OECD "Pension Markets in Focus" 2013, http://www.oecd.org/finance/PensionMarketsInFocus2013.pdf

OECD "Annual Survey of Large Pension Fund and Public Pension Reserve Funds" October 2013

http://www.oecd.org/daf/fin/private-pensions/LargestPensionFunds2012Survey.pdf

Towers Watson "Global Pension Assets Study" January 2013

Investment Company Institute, Quarterly Retirement Market Data, Second Quarter 2013, http://www.ici.org/research/stats

Pension Protection Fund 2013 Purple Book, http://www.pensionprotectionfund.org.uk/Pages/ThePurpleBook.aspx

** See also Pensions Institute (Cass Business School) 2013 'Returning to the Core - Rediscovering a Role for Real Estate in Defined Contribution Pension Schemes' Report for IPF, EPRA & AREF; other sources: Pensions Policy Institute 2012.

*** Among the best sourcess for DB Plans: IPE (Europe), P&I (US), IREI (Global), Cornell University and Hodes Weill Associates. Among the best for DC Plans: NAREIT, EPRA and APREA.

**** Source: NAREIT.