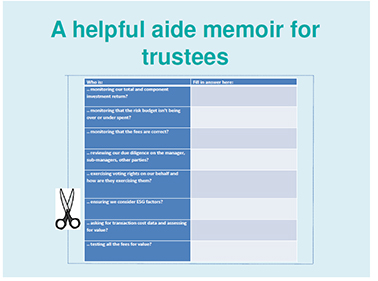

Richard Butcher faces the challenges of a trustee and provides a helpful aide to ensure the answer is always at hand

I got involved in a discussion recently about stewardship. "How do you decide how to exercise the voting rights on the shares that you hold within a trust?" I was asked "do you exercise the voting rights?" I was challenged.

Stewardship is one of those really tricky jobs for trustees. There seems to be evidence that it's good, and there are certainly codes that with varying degrees of urgency expect compliance.

It is not however a legal obligation, or a five minute job and as a consequence it often falls down the busy trustee agenda.

Stewardship, along with performance monitoring, due diligence, other ESG factors and most recently (at least in DC), good value and transaction cost analysis is part of investment governance.

This is a function that belongs to the trustee and is executed with varying degrees of thoroughness. I've not yet met a trustee board that doesn't look at investment performance and the fees they pay, but I have come across a few that don't monitor the efficient use of their risk budget and many that fail to refresh their investment manager due diligence and ESG factors.

I've yet to come across any that have completed a good value assessment or successfully extracted transaction cost data from their manager (although to be fair, these only became requirements in April).

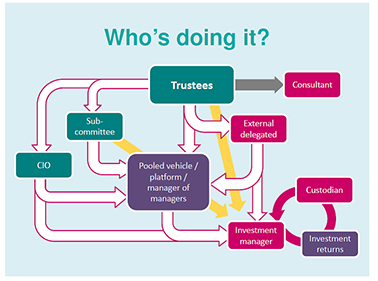

One of the reasons it's not executed with thoroughness is that it's really hard to work out who is doing or supposed to be doing what.

Trustees may or may not deal directly with their investment managers, they may deal through their consultant, or have a delegated function like a CIO, subcommittee or "fiduciary manager". Any of them, perhaps through one of the others, may deal direct with the fund manager, or none of them may deal direct, preferring instead to deal indirectly through a pooled fund, a platform or a fund of funds.

The infographic tries to represent this dogs dinner of players and routes to market. Trustees often make the assumption that someone, somewhere, must be doing these things. They are often wrong.

Ultimately, it is the trustees' job to ensure that the right things are done at the right time in the right way. The fact that a thorough governance job is difficult, does not excuse them from doing a thorough job.

One easy way to start this is to give the list of questions below to their investment consultant and ask him to fill it in. Do that, and next time you are challenged, the answer will be at your fingertips.

Written by Richard Butcher, Managing Director, PTL