What does this mean for pension funds?

What has happened?

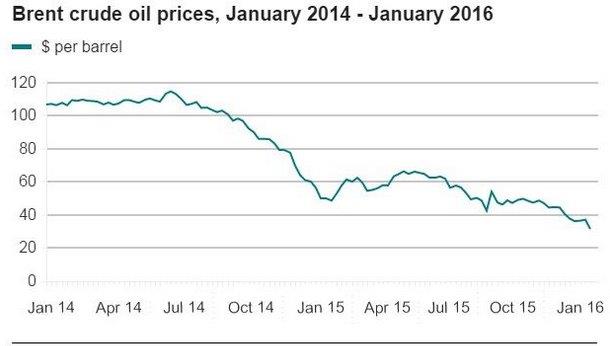

World oil prices have fallen from $110 a barrel in mid-2014 to just over $30 at the time of writing, as illustrated by the chart below:

Source: Bloomberg

Why has this happened?

In short, the key reason is supply.

US oil production was steady until 2012, when it suddenly began rising dramatically. Expressed in annual terms, US oil production jumped 50% in two years between 2011 and 2013.

The reason behind this increase – shale. Technological improvements meant that drillers could now extract oil from shale. When supply goes up, prices come down, and that is what has developed over the recent weeks.

At the World Economic Forum in Davos, Saudi Arabia indicated it would continue to flood the global market with oil. This will be exacerbated in March when Iran is likely to add an extra 300,000 barrels per day ("b/d") to an already saturated market, according to Fatih Birol, a Turkish economist and energy expert.

But that's only part of the story – demand has started to drop too.

China's economy, in particular, has slowed down from its strong growth of recent years. Other emerging markets are also showing slower growth.

Against this backdrop, speculative investors are causing distortions in the markets.

To highlight the recent impact on global markets, here is some press commentary from 21st January 2016:

-The Dow Jones and S&P 500 indexes (respectively) closed down 1.6% and 1.2%

-The main European stock exchanges also slid to a 15-month low

-Many markets are now in so-called bear territory – a fall of 20% or more from their most recent peaks

What a difference a day makes

Now we jump forward one day and the main headlines on the morning of Friday, 22nd January 2016 read:

-Asian stocks surge as oil climbs back over $30 per barrel climbing 6%

-Minor recovery as index bounces back from 12 year low

-European stock markets have opened around 1.5% higher as commodity prices bounce back

How has this impacted pension scheme trustees?

For those pension schemes with high allocations to equity, they will have seen volatile funding levels.

Those schemes that have a more diversified exposure to their growth assets with less invested in equity will have seen their funding levels better protected.

What does it mean for trustees?

For starters, they should not panic. Pension scheme trustees are typically long-term investors; therefore, some short-term volatility should not be a concern as they can ride out the volatility.

They should not make knee-jerk reactions. Trustees should consider whether these types of events have any implications for their investment strategy.

In order to do this, trustees need regular access to scheme risk analysis. Improvements in technology now mean that many trustees have access to this type of information – including daily funding level tracking and risk analysis.

This information will allow trustees to more effectively assess the risk within their portfolio and identify an asset mix that better matches their appetite for risk.

It will also help them be in a position to identify any market opportunities that arise, which then places them in a better position to take advantage of these opportunities.

Written by Neil Buchanan, actuarial technician, Spence and Partners